Casinos Sued for Facial Recognition Tech Use

Two casinos in Illinois are being sued in separate class-action lawsuits because of their use of facial recognition technology to identify cheating gamers. The Caesar’s Harrah’s Casino and Penn National’s Hollywood Casino, both in Joliet, are being accused of breaching the state’s Biometric Information Privacy Act.

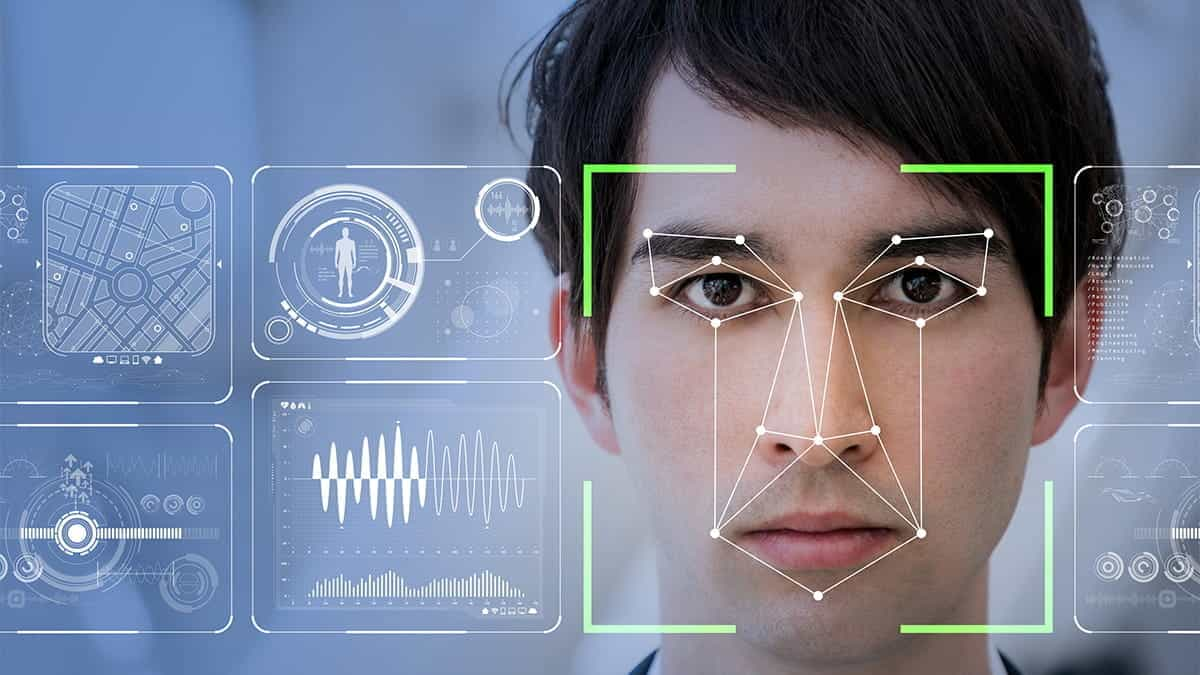

The technology, which has been increasingly popular with casinos across the nation, scans customer’s facial geometry to collect identifying information. The lawsuit has been filed on the grounds that the defendants:

- Failed to inform the plaintiffs and other casino rewards program members in writing then obtain consent for the collection of their biometric identifiers or information.

- Never established, followed and made publicly available a written policy that outlined a data retention schedule as well as guidelines for permanently destroying scans of plaintiffs’ and other rewards program members’ facial geometry.

The lawsuit against Caesars Harrah’s Casino was filed by co-plaintiffs Leon Martin and Anthony Adams, and seeks an award of liquidated or actual monetary damages. According to the lawsuit, both Martin and Adams are members of the Caesars rewards program who have collectively gambled at Harrah’s Joliet hundreds of times over the last few years.

The plaintiffs are represented by New York attorneys Joseph A. Fitapelli and Dana Cimera of Fitapelli & Schaffer and attorney Douglas Werman of Werman Salas P.C. in Chicago.

The same team of attorneys is also filing the near-identical lawsuit against the Hollywood Casino. This lawsuit was filed by Ava Jackson, who is a member of the Hollywood Casino’s rewards program. According to Jackson’s lawsuit, the facial recognition technology was used by the casino’s security cameras.

The lawsuit continues to explain that “each time plaintiff and other rewards program members gambled at defendant’s casino, defendant’s facial recognition technology scanned the geometry of their faces to identify them against stored facial geometry templates in defendant’s databases.”

According to both Joliet casinos, the technology was used to identify known cheaters. However, the use of the technology is flexible, with some looking to use it to identify and restrict the activities of problem gamblers or to tailor and individual gambling experience to users by tracking how frequently they visit the casino, their preferred games and spending habits.

The use of facial recognition technology is common in casinos, but two separate lawsuits in Illinois seek to challenge its non-consensual use. ?newsroom.cisco.com

While both casinos are yet to respond to the claims, there is evidence to suggest that the Harrah’s Casino was well aware of the potential for casinos to share facial recognition data with other casinos.

On October 4, Bill Doolin, a surveillance manager for Harrah’s described the technology used at the casino described facial geometry scanning as an effective way to report and catch cheaters in a company testimonial for the technology provider, Biometrica.

“As other properties which belong to that network catch somebody, they send a report that goes to all of the other casinos in the network,” said Doolin. “Within an hour or two of them catching someone, maybe in Nevada or in Atlantic City, all of the casinos in that network will have that information available to them.”

The Case Potential

It is expected that the class-action suits could grow to include hundreds of plaintiffs. This would include other rewards program members who felt that the defendants’ use of the technology was either reckless or negligent.

As for the success of the lawsuit, it looks as though precedent may favor the plaintiff’s side . Enacted in 2008, Illinois’ Biometric Information Privacy Act (BIPA) requires that people must provide consent for the collection and use of their biometric data.

This year, the Illinois Supreme Court ruled that BIPA does not require actual injury or harm to bring a claim. The court’s ruling was applied to the case of Rosenbach v. Six Flags. The case was filed after a 14-year-old’s thumbprint was taken without consent at Six Flags amusement park.

A lot of the concern centers around the potential of this data to be hacked, but security professionals are adamant that the technology is important in the fight for casino security.

According to Anthony Cabot, a professor of gaming law at UNLV Boyd School of Law, facial recognition collection could be a useful tool for identifying terrorist and criminal activity in casinos. Regardless, he still highlighted the importance of securing the integrity of the information.

“For example,” he asked, “Can you capture an otherwise anonymous person playing in the casino, derive his or her identification from public records and then sell that information to a third-party timeshare company so they can market to the person?… What policymakers need to focus on is the use and confidentiality of the information in other contexts.”

The lawsuit could be a pivotal moment in a growing conversation around the legal use of facial recognition technology by casinos across the nation. While gaming venues have used facial recognition tech since the 90s to help identify problem gamblers, the evolution of the technology has raised privacy concerns.

According to Peter Hanna, a privacy attorney and president of Illinois’s ACLU Next Generation Society, the technology is more prevalent than most people realize.

“The use of biometrics in casinos has only become more sophisticated and widespread… every day every person walking through a casino is having their facial geometry captured and processed”– Peter Hanna, President, Next Generation Society

Online Casinos UK

Online Casinos UK